Property taxes due Feb. 1

Published 12:00 am Thursday, January 20, 2011

NATCHEZ — Those who want to avoid paying interest on their property taxes should have their checks signed and delivered by Feb. 1.

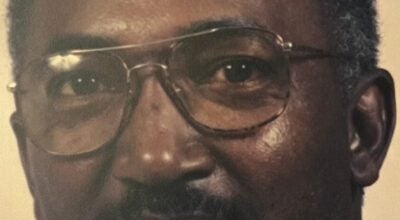

Tax Collector Peter Burns said a 1-perecnt interest penalty fee will be added to property tax bills each month following the deadline.

A delinquent list of names of those who have not paid their property taxes will be published in the newspaper twice in August before the Aug. 29 tax sale, Burns said.

After the tax sale, residents can still redeem their property for at least a year. But starting in September, the penalty fee will increase to 1.5 percent interest.

Burns said the assessed value of real estate property taxes for 2010 increased by 1 percent compared to 2009.

Burns said he has collected 8 percent more property taxes so far this year compared to the same date last year.

Burns said an 8-percent increase is notable and might imply difficult economic times are improving.

“It’s hard to say why (more money has been collected earlier this year), but to me it might indicate the economy is a little better,” Burns said.

“People are turning their money loose a little bit earlier (than last year).”

Tax receipts are mailed out in mid-to late-November, and the first collections usually begin at the end of November, Burns said.

January is generally the month when most taxes are collected, he said.

“I guess it’s just human nature; people tend to put things off,” Burns said.

He said some people pay their taxes prior to the start of the New Year or after Jan. 1 for business purposes, as well.

Burns, who worked in the tax assessor’s office for 10 years, said assessors use a formula from the Bureau of Revenue, formerly known as the State Tax Commission.

Burns said a population increase can account for an assessment increase, but not necessarily.

Since assessments are constantly changing, it is difficult to predict or account for changes from year to year.

“It’s like shooting at a moving target,” Burns said.

Real estate ownership turnover is a factor, for instance.

People 65 or older or those who are disabled have a greater tax exemption than someone who is 25 or 30, Burns said.

Assessed values were compiled in June and given to the Natchez-Adams School Board, Adams County Board of Supervisors and Natchez Board of Aldermen.

Each board uses the assessed values to determine what millage to levy in order to budget effectively.

Burns said he makes daily deposits of the taxes he collects, and each board receives the property tax revenue on a monthly basis.